Airfreight rates remain firm despite e-commerce concerns

Thursday, February 20, 2025Airfreight rates have remained firm over the last week despite concerns the market could take a hit due to the addition of US tariffs on China, the temporarily aborted de minimis ban and the Lunar New Year slowdown.

The global Baltic Air Freight Index (BAI00) calculated by TAC Index shows that last week average airfreight rates – based on spot and contract – were up 1.7% week on week and 12.8% ahead of a year ago.

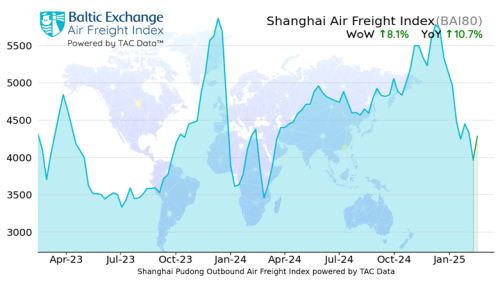

Rates out of China were “slightly higher” last week to both Europe and the US, with outbound Shanghai increasing 8.1% week on week and 10.7% ahead of last year. Rates from Hong Kong didn’t perform quite as well – declining 0.9% week on week – but remain 14.2% ahead of last year.

Sources reported little change to spot rates from Hong Kong over the week, TAC Index said.

The firm rates come as e-commerce flights have been cancelled and volumes have declined in recent weeks, although industry observers have commented it is hard to disentangle how much of this decline was caused by the Lunar/Chinese New Year holiday across Asia starting in early February and how much is down to the shortlived de minimis ban.

”The relatively firm tone to the market confounds some expectations that fears over rising tariffs and the threatened end to the ‘de minimis’ exemption for smaller parcels entering the US might hit volumes and rates hard, amid reports of some e-commerce flights already getting cancelled,” TAC said in a market analysis.

“Rates reported so far in the period post-Chinese New Year do not reflect anything so dramatic, at least not yet.”

TAC added that out of Europe, overall rates were rising on most major lanes including to China and to Japan as well as to the US. Overall rates from the US were slightly higher again to Europe while slightly lower both to China and to South America “though not from Miami, which does the lion’s share of air cargo business between the US and Latin America”.

Last week analyst WorldACD said tonnages from China to the US “dropped steeply” in week 5 (27 January-2 February) and week 6 (3-9 February).

“It’s difficult to separate how much of that decline was simply linked to the annual holidays and factory closures in China in the weeks before and after LNY, and how much resulted from the Trump administration’s sudden decision to revoke access to Section 321 customs-free ‘de minimis’ import processes for imports from China,” said WorldACD.

WorldACD said the resulting customs processing backlogs, which led swiftly to that presidential order being suspended, resulted in dozens of e-commerce-loaded freighter flights being cancelled.

In early February, the US temporarily reversed its decision to block the de minimis exemption that allowed packages worth less than $800 to be imported into the country duty-free.

A statement from the White House said that the exemption would be reinstated while systems are put in place to process the millions of de minimis – or section 321 – packages that US customs processes each day.